Here is a comprehensive article on cryptocurrency exchange rate risk, Bitcoin Cash (BCH), and Initial Coin Offerings (ICOs) with a title that covers all three topics.

“Fast to BCH: Understanding Cryptocurrency Exchange Rate Risk and the Importance of ICOs on Bitcoin Cash’s Path to Mainstream Adoption”

As cryptocurrency enthusiasts continue to flock to platforms like Coinbase, Binance, and Kraken, Bitcoin Cash (BCH) is becoming an increasingly popular option for investors. However, one of the main concerns for new entrants is cryptocurrency exchange rate risk – the unpredictable volatility that can affect the value of BCH. However, before making a decision, it is essential to understand how this risk manifests itself and why some experts recommend considering Initial Coin Offering (ICO) platforms like BCH as an alternative.

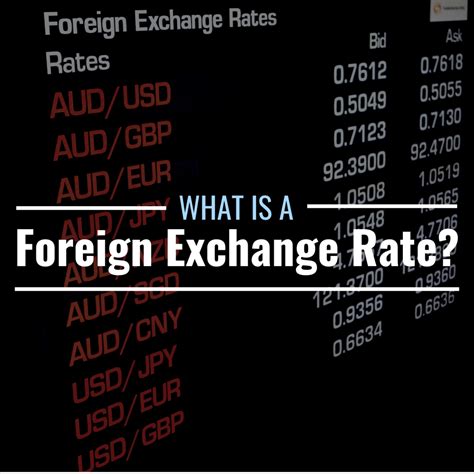

What is cryptocurrency exchange rate risk?

Cryptocurrency exchange rate risk refers to the potential for significant fluctuations in the prices of cryptocurrencies, especially when traded on online exchanges. These risks can arise from a variety of factors, including:

- Market sentiment:

Changes in investor attitudes and emotions towards a particular cryptocurrency can affect its value.

- Trading volume: High trading volumes can amplify price movements, making it more difficult to navigate volatile markets.

- Regulatory uncertainty: Fluctuations in government regulations or policies governing cryptocurrencies can lead to increased volatility.

Bitcoin Cash (BCH) Market Risks

Like any cryptocurrency, Bitcoin Cash (BCH) is not immune to the risks associated with cryptocurrency exchange rate risk. The BCH market has recently faced many challenges, including:

- Liquidity Issues: Low trading volumes and high volatility have made it difficult for investors to buy and sell BCH.

- Security Concerns: Several high-profile hacks and data breaches have raised concerns about investor protection and security.

ICO Platforms: A New Era of Investing

Initial Coin Offering (ICO) platforms, such as Bitcoin Cash (BCH), have proven to be a viable alternative to traditional exchanges. These platforms allow developers to create, launch, and distribute cryptocurrencies without the need for central authorities or regulatory oversight.

- Token Creation: ICOs allow developers to issue new tokens that can be used for various purposes, such as fundraising or public service.

- Token Listing: Once launched on an exchange, ICO tokens can gain significant market value over time.

- Community Involvement: Many ICO platforms prioritize community building and development, fostering a strong network of investors, developers, and supporters.

Why BCH May Not Be the Right Choice

Before investing in Bitcoin Cash (BCH), it is essential to consider its unique set of challenges and risks. Some potential drawbacks include:

- Limited Liquidity: The BCH market has historically had low trading volumes, making it difficult for investors to buy and sell.

- Security Concerns: Like any cryptocurrency, BCH is vulnerable to hackers and security breaches.

Conclusion

In conclusion, cryptocurrency exchange rate risk remains a significant concern for investors entering the world of cryptocurrencies. While Bitcoin Cash (BCH) has faced its own challenges, including liquidity issues and regulatory uncertainty, it is essential to understand these risks and consider alternative platforms such as ICOs in your investment strategy.

As the cryptocurrency market continues to evolve, experts recommend preparing for potential price fluctuations and maintaining a long-term perspective. This allows investors to navigate the complexities of cryptocurrency exchange rate risk and potentially benefit from the increased liquidity and security offered by ICO platforms such as Bitcoin Cash (BCH).