The high price of the transaction: understanding of cryptocurrency gas rates

When the global economy changed to digital currencies and decentralized transactions, the landscape will continue to develop rapidly. Gas rates are a crucial aspect that resellers need to take into consideration when using cryptocurrencies for their business. Gas rates are the costs associated with transaction processing in a blockchain network, such as bitcoin or ethhereum. In this article, we will deal with cryptocurrency gas rates because they are essential for resellers and how they can alleviate their effects.

What are cryptocurrency gas rates?

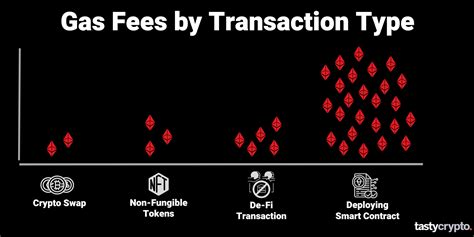

Gas rates are essentially the “business cost” in a decentralized network. They represent the amount that miners pay to validate transactions and add new blocks to blockchain. In return, they gain coins or cryptocurrency tokens newly formed as a reward. The more complex and that consumes a transaction (for example, a large number of transactions sends), the higher the gas rates.

Why are cryptocurrency gas rates important to retailers?

Resellers who participate in cryptocurrency markets depend on quick, reliable and cheap transactions to make their business easier. High gas rates may have a significant impact on trade performance, which leads to losses or even retailers forces to give up their positions as a whole. Here is the reason:

- Retard the market : Increased gas rates leads to slower transaction times, which can lead to lost options or late orders.

- Reduced liquidity : Higher gas rates can lead to the market for lower or those without essential capital reserves, a more difficult reduction in liquidity and greater volatility.

- Higher costs

: gas rates are not just specific transaction costs; They also contribute to the general operating costs of cryptocurrency exchanges.

Factors that influence cryptocurrency gas rates

Several factors influence gas rates on different blockchain networks:

- Network overload : High network activities, p. B. During the main trading hours or when a new main project begins, higher gas rates may lead to higher gas rates.

- Transaction volume : Other transactions mean more complex blocks and higher gas rates.

3.

The effects of cryptocurrency gas rates

Although gas rates on blockchain networks are the costs needed for business, retailers can take steps to minimize their effects:

- Choose Scholarships with competitive gas rates : Exchanges that offer lower or more transparent gas rates can help reduce costs.

- Use older coins with lower transaction rates : Some cryptocurrencies, such as binance coin (BNB) and polygon (matic), have lower gas rates than others.

- Consider the use of alternative payment methods : Services such as BitPay and Coulbase Wallet allow faster transactions at lower costs.

- Optimize your commercial strategy : Commercial strategies that contain fewer transactions can help reduce gas rate costs.

Diploma

Cryptocurrency gas rates are an essential aspect of the ecosystem, which increases transaction processing times and reduces liquidity. Resellers should be aware of these costs if they do business and check the options to minimize their effects. By selecting stock bags with competitive gas rate models, the help of old currencies or alternative payment methods and optimizing trading strategies, retailers can control the high price of transaction rates in the cryptocurrency world.

Recommendations:

- Researchers with low or transparent gas rates before placing business.

- Consider using old coins such as BNB, Matic or NFTs with lower transaction rates.

- Use services like Bitpay and Coinbase Wallet for faster transactions at lower costs.